Banks and lending institutions usually ask for past two to three months’ salary slips at the time of granting loans. Therefore, a salary slip is a document that is required when applying for a loan or even a credit card.

It helps to assess the financial stability of the employee seeking a loan. It acts as legal proof of the ability to repay the credit taken as a loan within a prescribed time limit. Often, while applying for travel visas or to universities, applicants are asked to furnish a copy of their salary slip as proof of employment and designation.Ī salary slip contains all the details of the salary. Salary slips are important legal evidence of employment. It also helps them negotiate salary with new employers or for new roles. It is an important document to avail loans, credit, mortgage and other borrowings from banks and financial institutions.Įmployees can compare offers from new employers based on their previous salary slips.

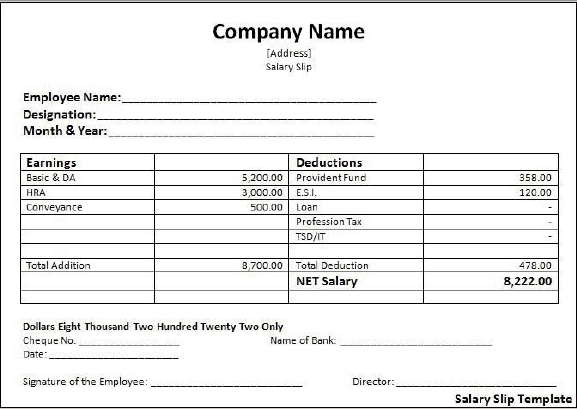

Salary slips provide lenders with assurance that their lendings will be repaid. The salary slip gives employees access to various free or subsidised facilities provided by the government such as medical care, subsidised food grains, etc. It helps to prepare the Income Tax Returns (ITR) and determine how much tax is to be paid or how much refund is to be claimed by the employee for the year. The salary slip forms the basis for income tax calculation. List of earnings (income) and deductionsĪn example of a salary slip is provided below: Importance of a Salary Slip Basis for income tax payment.EPF account number and UAN (Universal Account Number).Employee PAN/Aadhaar number and bank account number.Employee name, code, designation and department.

The format of salary slips differs for different companies.

0 kommentar(er)

0 kommentar(er)